Court Costs, Fines, and Fees Are Bad Policy

Across the country, regressive court fines, administrative costs, and filing fees are functioning to penalize people solely for their poverty.

Court costs, fines, and fees (also known as “monetary sanctions”) exist in both the civil and criminal realms of the justice system and are applied in all 50 states. Illinois, specifically, imposes a panoply of these costs in connection with various proceedings and convictions in both civil and criminal courts, with approximately 90 distinct fines or fees on the books today. These racked charges include, among others: “reimbursement” fees to police, prosecutors, and public defenders; probation oversight fees; costs for electronic monitoring bracelets, drug-testing, participation in court-ordered programs; fees for document storage and delivery; and many more. In Illinois, there is no limit to the amount of money that can be sanctioned in a single case.

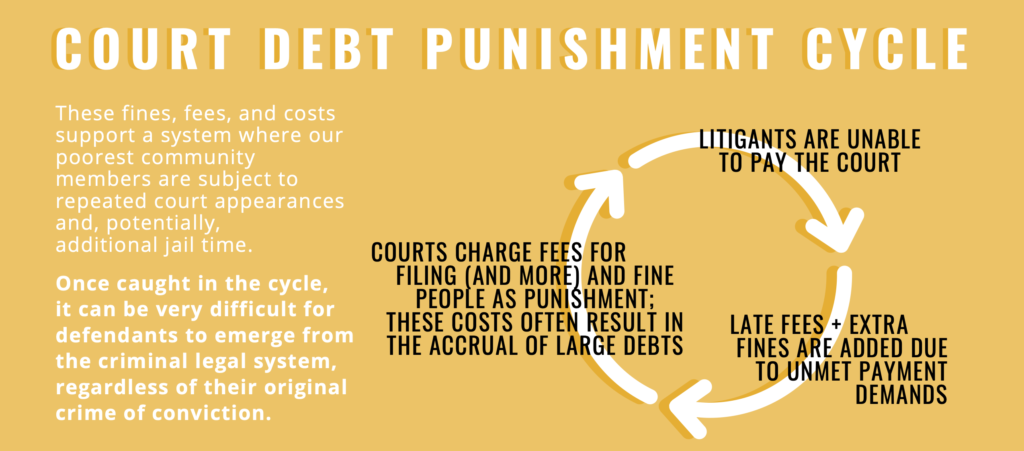

When our courts impose a barrage of costs, fees, and fines on people least able to afford them, these litigants quickly accrue unmanageable debt that prevents them from ever escaping the myriad collateral consequences that impact the person’s ability to move beyond their system involvement.

Some of these costs are relatively manageable on their own, like a $10.00 (plus postage) mailing fee, but for many criminal defendants – especially those living in poverty, operating without an attorney, or dealing with the many other very real pressures of day-to-day life – these complex and opaque court debts can trap litigants in never-ending cycles of poverty and, often, carceral punishment. In all 50 states, it is effectively possible to incarcerate someone for failure to pay a criminal justice debt (pg. 17), but that is not all: unpaid criminal justice debt can lead to direct restrictions on one’s civil rights (loss of the right to vote), poverty penalties (extra fees, late charges), poverty traps (revocation of driver’s license, denials of public aid), and even systemic corruption of both court and government actors.

Today, Chicago Appleseed and the Chicago Council of Lawyers release our report, Court Costs, Fines, and Fees are Bad Policy: Recommendations for Illinois Legislators (researched and written by Collaboration for Justice Fellow, Emma Marsano) that examines the growing body of evidence proving, by every reasonable metric, that monetary sanctions are ineffective and harmful.

Though their use is typically justified to appeal to three main goals – punishment, revenue-raising to recoup court system expenses, and fairness – each of these explanations is easily debunked:

First, to cite ‘fairness’ as a justification for monetary sanctions ignores the fact that the targeted use of fines and fees is a historical practice used to reinforce anti-Black racism and extract wealth from Black communities. The prominence of fines by state governments can be traced to the Reconstruction era’s “Black Codes,” which were enacted to “maintain the pre-[Civil] War racist hierarchy,” as affirmed in the 2019 U.S. Supreme Court case Timbs v. Indiana. These fines were levied for a wide-range of vague offenses like “vagrancy,” which forced Black citizens into incarceration and involuntary labor (in other words, re-enslavement) when they inevitably could not afford to pay. Later, the racist “tough on crime” policies of the 1980s – as well as shifts toward austerity – transformed monetary sanctions into the preferred method of punishment for “low-level” violations or “petty” misdemeanors. As recently as 2015, a Department of Justice investigation into the murder of Michael Brown by police in Ferguson, Missouri, unearthed a scheme by the Mayor’s Office and law enforcement to fine Black and lower-income residents at exorbitant rates in order to raise municipal funds.

The very mechanisms (courts, prosecution, detention, corrections) that systematically oppress Black communities continue to forcibly – through monetary sanctions and more – extract funds from Black communities today. Around 85% of people owe some kind of criminal justice debt upon being released from prison (pg. 4), and Black and “Hispanic” adults are 5.9- and 3.1-times more likely, respectively, to be incarcerated in the U.S. than White adults. After having been unable to earn money while incarcerated, a debt of any amount can be totally devastating for impacted people and their families. When not paid immediately or in full, these fines and fees can lead to crippling debt, socioeconomic hardship, legal consequences, and even incarceration that perpetuate cycles of incarceration and poverty. Once caught in the cycle (the imposition of fines, fees, and costs; inability to pay; and the additional fines and fees that result from not paying), it can be extremely difficult for defendants to emerge from the criminal justice system, regardless of their original crime of conviction. With over three-quarters of Cook County’s carceral population identified as Black or Latinx, the disproportionate impact criminal justice debt has on the county’s majority Black and Brown communities is unconscionable.

Access to money often correlates with access to justice and criminal court debt is no different, acting as a poverty penalty that fails to ‘punish’ for or deter from crime. A poverty penalty refers to consequences that are more severe for a poor person than for a wealthier person as a direct result of poverty (pg. 17). The systemic violence of economic inequality in the U.S. ensures that any level of monetary sanction used to ‘punish’ a person relies solely on one’s wealth. For example, when a wealthy person is assessed a fine of $300, they are typically able to pay it immediately – it is inconsequential to their survival – whereas for a low-income single mother or college student, a $300 fine could mean choosing between buying groceries or paying rent. These kinds of personal and economic consequences of criminal justice debt tend to far outweigh alleged crimes, and since criminal justice debt also comes with a host of escalated enforcement mechanisms when not paid in full (unlike civil debts), these consequences may actually force people into a position where they recidivate. Continued cycles of carceral punishment and poverty do the exact opposite of ‘deter’ crime:

This history illuminates the fundamental contradiction at the core of policies that impose monetary sanctions: the claim that economic punishment functions as a deterrent for law-breakers has little empirical backing…but there is clear evidence that, for hundreds of years, monetary sanctions have been used to balance budgets at the expense of the most marginalized U.S. citizens, often wielded as tools of racist subjugation.

Court Costs, Fines, and Fees are Bad Policy: Recommendations for Illinois Legislators from Chicago Appleseed & Chicago Council of Lawyers (pg. 2) – Emma Marsano, July 2020

Racist public policy and practices in law enforcement, prosecution, sentencing, corrections, and other criminal legal realms have led to decades of harsh and unjustified ‘punishment’ through U.S. carceral systems for Black, Brown, and Indigenous people. Especially in heavily-segregated areas with high-concentrations of poverty, the cycles of debt and carceral punishment caused by compounding criminal system injustices – including, but not limited to monetary court sanctions – create intergenerational trauma for entire communities.

Moreover, the costs of collecting court debt are likely much higher than the revenue actually raised through fines and fees. There is no particularly good way to calculate the exact to cost-to-benefit ratio of administering the system of monetary sanctions, since no uniform data collection process exists – at least in Illinois – but it is clear that money sanctions in no way recoup the expenses of the legal system. Evidence shows that the cost of collecting fines and fees could be up to 80% the total amount actually collected by the court system (pg. 13). Criminal justice debt collection processes are estimated to cost the courts approximately 121-times more to collect than it costs to IRS to collect federal taxation (pg. 19). Further, the revenue actually raised through monetary sanctions is minuscule in comparison to and in no way recovers the excessive amount spent on law enforcement and corrections each year; collectively, U.S. jurisdictions spend about $100-billion on policing and another $80-billion on incarceration annually (pg. 5).

Reforms have been implemented or suggested in many jurisdictions across the country recently, and in 2019, Illinois enacted the Criminal and Traffic Assessments Act (CTAA) – a policy initiative Chicago Appleseed and the Council have advocated for years. The CTAA, among other things, mandates that people have an opportunity to request a full or partial waiver of criminal court fees and fines based on economic hardship. People whose income is below 200% of federal poverty guidelines are now eligible for a full waiver of monetary sanctions, while those earning up to 400% of the poverty level are eligible for a sliding scale reduction in the amount they must pay. Chicago Appleseed and the Chicago Council of Lawyers are thrilled about the potential of the legislation, but remain convinced that more must be done to improve equity in our courts and reinvest in justice.

The CTAA’s waiver pilot program was scheduled to sunset in 2021, but due to the COVID-19 pandemic, is expected to be extended until 2022 by an act of the legislature. If the waiver legislation sunsets, it will remove even the barest protections for non-wealthy convicted persons; extension beyond 2022 will require legislative approval specific to this law. Further, the majority of the more-than-90 distinct fines or fees on the books in Illinois before the CTAA remain in effect today and there is no limit to the amount of money that can be sanctioned in a single case. To address these issues, in addition to extending the sunset date past 2022, we encourage all Illinois legislators to:

- Support efforts to establish a Committee for Data Collection;

- Work with the State of Illinois to fully fund the court system;

- Eliminate outstanding criminal justice debt;

- Remove collateral consequences of monetary sanctions;

- Ensure that the Illinois Courts improve ability-to-pay hearings;

- End monetary sanctions as punishment and revenue collection; and

- Make reparations and amends to Black communities.

Our report, Court Costs, Fines, and Fees are Bad Policy, explains in much greater detail how monetary sanctions fail to meet their stated goals of punishment, court funding, and fairness; how the legal, economic, and collateral consequences of criminal justice debt that far outweigh any possible benefits; and includes our recommendations for legislators as they fight for equity in Illinois. With our original coalition of community organizations and advocates that supported the passage of the CTAA, we are monitoring its implementation of the waiver process in courts throughout Illinois. We hope to both understand its impact on fairness and advocate for institutionalization after the sunset date passes in order to ensure accessible justice – regardless of race or socioeconomic status.