Time to Reconvene the Supreme Court Task Force on Court Costs, Fines, and Fees

In 2016, the Illinois Supreme Court’s Statutory Court Fee Task Force released a report finding that the state’s “byzantine system” of court costs, fines, and fees varied wildly by county and disproportionately impacted low-income Illinois residents. These findings pushed forward legislation – the Criminal and Traffic Assessments Act (CTAA), enacted in July 2019 – to reform this system.

The CTAA, among other things, created full and partial court fee waivers based on economic hardship for people earning up to 400% of the federal poverty level, but Illinois still imposes a vast array of these costs in connection with both civil and criminal courts—approximately 90 distinct fines or fees on the books today. These racked charges include, among others: “reimbursement” fees to police, prosecutors, and public defenders; probation oversight fees; costs for electronic monitoring bracelets, drug-testing, participation in court-ordered programs; fees for document storage and delivery; and many more. In Illinois, there is no limit to the amount of money that can be sanctioned in a single case and no strict structure across counties, but there are mandatory minimums; judges can impose fines reaching up to $25,000 for a felony or $2,500 for a misdemeanor. In many Illinois counties, defendants can easily be charged $2,500 in monetary sanctions for a misdemeanor case before racking up late fees and interest and other fees charged by collections agencies.

Chicago Appleseed and the Chicago Council of Lawyers are thrilled about the potential of this legislation, but remain convinced that more must be done to improve equity in our legal system. Further, the CTAA’s waiver pilot program was scheduled will sunset in 2022. If and when that happens, it will remove even the barest protections for non-wealthy convicted people.

Court fines, costs, and fees – legal financial obligations (LFOs) – are not used in a rehabilitative manner as a part of one’s sentence, but instead fund the court system and other government services on the backs of our most vulnerable residents. LFOs trace back to the post-Civil War Reconstruction Era and are another reminder of the ways Jim Crow continues to this day. Research suggests that jurisdictions with larger shares of Black residents tend to impose more court-related monetary sanctions; an increase in an area’s Black population by 1% is associated with an over $34,000 in additional annual revenue collected from fines and fees in that jurisdiction. For instance, following the 2014 murder of Michael Brown by a police officer in Ferguson, Missouri, an investigation revealed the city’s aggressive use of monetary sanctions against Black communities. This led to further research uncovering many jurisdictions throughout the country that are functioning similarly to Ferguson, using LFOs to raise revenue primarily from persecuting Black and Brown people. In fact, a study by Dan Kopf in 2016 showed that the 50 cities with the highest proportion of revenue collected from LFOs had median Black populations that were five times higher than the national average.

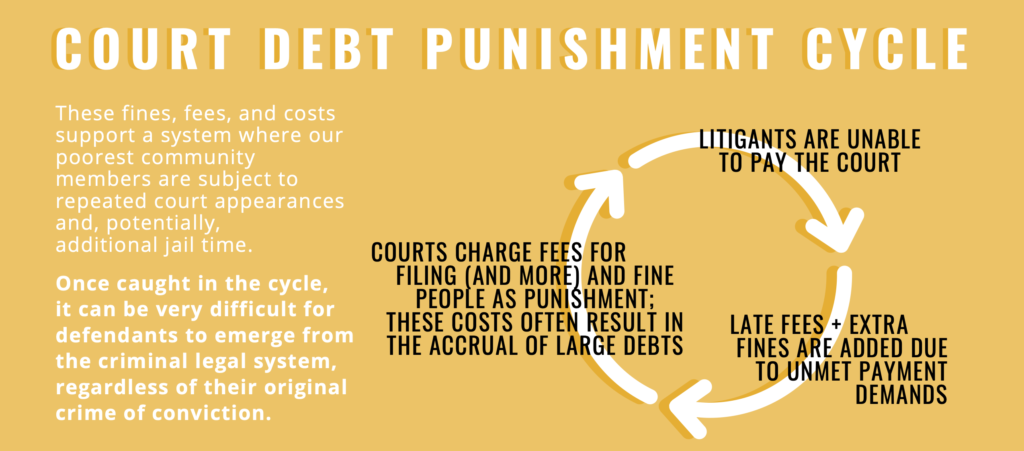

When our courts impose a barrage of costs, fees, and fines on people least able to afford them, these litigants quickly accrue unmanageable debt that prevents them from ever escaping the myriad collateral consequences that impact the person’s ability to move beyond their justice system involvement.

Monetary penalties – late fees, re-incarceration for “willful” non-payment, and the extension of probation, for example – are mechanisms that result in increased police enforcement in the hardest-hit communities throughout every county in Illinois. Public defenders in Cook County have also reported clients being denied anger management and substance abuse treatment options as alternatives to incarceration due to outstanding debt. Court debt can prevent people from receiving their wages, accessing housing, and can even lead to driver’s license suspension. All of these factors create further economic insecurity and severely impact one’s ability to maintain employment.

Many Illinois cities and counties rely heavily on LFOs as a source of revenue, but the system in Cook County has a particularly disparate impact on Black and Brown communities in Chicago. The Cook County Sheriff expects to collect $15.8 million in revenue from vehicle tickets, alarm permits in unincorporated Cook County, and fees collected for summonses and evictions in fiscal year 2021. This year though, according to the Cook County Board President’s 2021 Budget Proposal, the Sheriff is projecting only $9.3 million in revenue because of a “reduction in ticket citations due to stay-at-home orders, as well as a moratorium on evictions as a result to the COVID-19 pandemic.” The heavy enforcement of LFOs among these communities creates an enormous barrier to justice and perpetuates harmful economic inequality. Clearly, there is a better way to fund our justice system other than on the backs of our poorest community members.

To address these issues – in addition to extending the sunset date past 2022 – we encourage the Illinois legislature create a new Supreme Court Task Force to guide and evaluate the implementation of the CTAA.

This Task Force should be comprised of representatives from diverse backgrounds—including criminal justice advocates, research professionals, and community members in addition to judges and clerks—in order to guide the policy analysis and discussion through an anti-racist, community-informed, restorative lens. The new task force should include:

- Oversight of statewide and county-specific data relating to the collection of court costs and fees;

- Analysis of these data and research to document both the revenue from and the costs of collecting these debts; and

- Community-led impact research to understand how imposition of court debts affects individuals, families, and the public at large.

LFOs are not a productive rehabilitative method, place and unjust burden on low-income people of color, are very unlikely to financially benefit courts, and there is strong evidence that current LFO policies are unconstitutional. The Eighth Amendment of the United States Constitution prohibits excessive punishment—including excessive fines; the Fourteenth Amendment states, as a universal principle, that discrimination on the basis of wealth is a violation of one’s due process rights. There’s no doubt that the imposition of thousands of dollars in fines can be considered an excessive punishment for almost anyone—especially when considering the extreme negative consequences this kind of debt can have and that little of the collected fees are given to victim restitution. The Illinois Constitution guarantees all people the right to free access to justice. When one can easily accrue thousands of dollars of criminal justice debt from a single case, this is inarguably not ‘free’ access, especially when considering the punitive repercussions of carrying this debt.

Given the overwhelming evidence that court costs, fines, and fees are bad policy due to their severe and disproportional burden on Black, Brown, and lower-income communities, why do exist at all?

There is a common misconception that court costs, fines, and fess are a key revenue source for the cities and counties that administer the Illinois legal system. However, research demonstrates that jurisdictions throughout Illinois are very likely spending dollars to collect pennies in LFOs. The collection services used are often hired out to private agencies at a steep cost to the court system, and in many situations, these debts still go largely unpaid, meaning that the county has spent money in order to collect money to no avail.

With the establishment of an Illinois Supreme Court Task Force, we hope to delve deeper into the impact of the enforcement of LFOs today and examine their legality in order to ensure that the CTAA is a fair, reasonable, and anti-racist policy. As the evidence above clearly indicates, reforms must be made to the LFO policy in the state of Illinois in the interest of justice for all. In order to do this, Chicago Appleseed and the Chicago Council of Lawyers strongly encourage the creation of a new Supreme Court Task Force to guide these policy changes. We advocate for the analysis and reworking of these policies so that they do not inflict further harm upon marginalized communities and are more functional for the criminal justice system.

For more information about the impact that court costs and fees are have on our society, please see our Community Resource Hub and our report, “Court Costs, Fines, and Fees are Bad Policy.”

Gabbie Cooper is a fourth-year student at Northwestern University studying Social Policy. With a background in criminal justice advocacy and research. At Chicago Appleseed, Gabbie works assists with development and social media, in addition to advocacy and research on economic justice issues. Moving forward, Gabbie hopes to work in the nonprofit sector and one day go to law school.